Cryptocurrency trading has become a hot topic in the world of finance, drawing the attention of both seasoned investors and newcomers alike. In the ever-evolving landscape of digital assets, understanding cryptocurrency trading is crucial for anyone looking to dive into this exciting and potentially lucrative market. This comprehensive guide will take you on a journey through the intricacies of cryptocurrency trading, helping you grasp the fundamentals and make informed decisions.

The Basics of Cryptocurrency Trading

What is Cryptocurrency?

Let’s begin with the basics. Cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks, typically based on blockchain technology. The most famous cryptocurrency, Bitcoin, was created by an anonymous person or group of people using the pseudonym Satoshi Nakamoto in 2009. Since then, thousands of cryptocurrencies have emerged, each with its own unique features and purposes.

What is Cryptocurrency Trading?

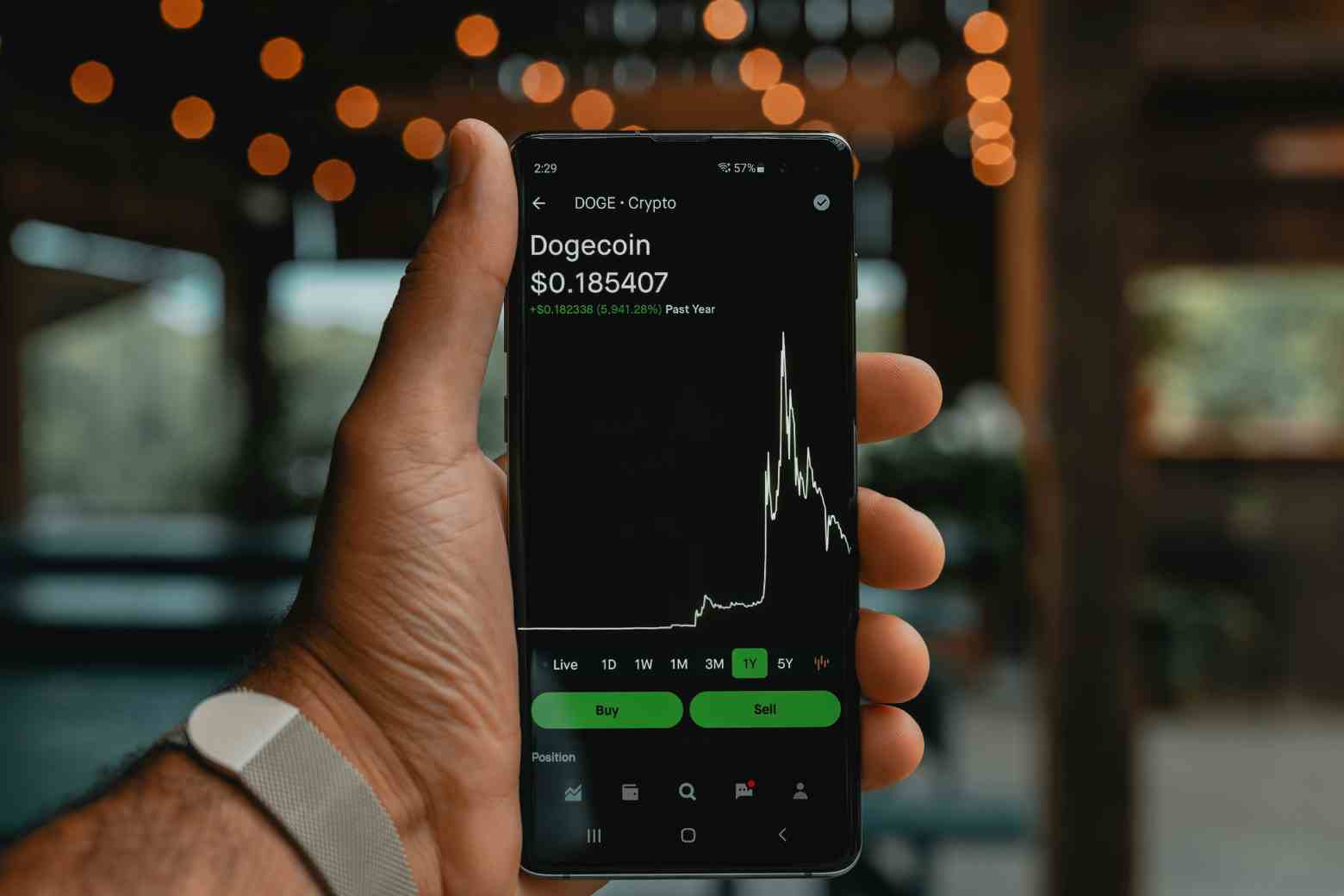

Cryptocurrency trading involves the buying and selling of cryptocurrencies on various online platforms, known as crypto exchanges. These exchanges facilitate the exchange of one cryptocurrency for another or for fiat currencies like the US Dollar (USD) or Euro (EUR). Traders aim to profit from price fluctuations by buying low and selling high or by engaging in short-selling strategies.

Types of Cryptocurrency Trading

Spot Trading

Spot trading is the most straightforward form of cryptocurrency trading. It involves the immediate exchange of one cryptocurrency for another at the current market price. This type of trading is suitable for beginners as it does not involve complicated strategies.

Derivatives Trading

Derivatives trading allows traders to speculate on the price movements of cryptocurrencies without actually owning the underlying assets. Popular derivatives products include futures contracts and options contracts. Derivatives trading can be more complex and carries higher risks, making it better suited for experienced traders.

Margin Trading

Margin trading enables traders to borrow funds to increase their trading positions. While this can amplify profits, it also increases potential losses. Traders must be cautious when engaging in margin trading, as it involves borrowing money and paying interest on borrowed funds.

Cryptocurrency Exchanges

Selecting the right cryptocurrency exchange is essential for successful trading. Exchanges vary in terms of security, fees, available cryptocurrencies, and user interfaces. Some well-known exchanges include Binance, Coinbase, and Kraken. Be sure to research and choose a platform that aligns with your trading goals and risk tolerance.

Getting Started with Cryptocurrency Trading

Creating an Account

To start trading, you’ll need to create an account on a cryptocurrency exchange. This typically involves providing identification documents, setting up two-factor authentication for added security, and verifying your identity.

Depositing Funds

After creating an account, you’ll need to deposit funds into your exchange wallet. Most exchanges accept deposits in various cryptocurrencies and fiat currencies. Ensure you understand the deposit methods and fees associated with your chosen exchange.

Analyzing the Market

Successful cryptocurrency trading requires market analysis. There are two primary approaches:

- Fundamental analysis: This involves evaluating the long-term value of a cryptocurrency based on factors such as technology, team, adoption, and use cases.

- Technical analysis: Traders use historical price charts and indicators to predict future price movements.

Placing Orders

To execute a trade, you’ll need to place an order on the exchange. Common types of orders include:

- Market orders: These orders are executed at the current market price, ensuring immediate execution.

- Limit orders: Traders specify the price at which they are willing to buy or sell a cryptocurrency. The order is only executed if the market reaches the specified price.

- Stop orders: These orders are used to limit losses or lock in profits. They become market orders when a specified price level is reached.

Risk Management

Managing risk is paramount in cryptocurrency trading. Here are some essential risk management strategies:

- Diversification: Avoid putting all your funds into a single cryptocurrency. Diversifying your portfolio can help spread risk.

- Stop-loss orders: Set predefined price levels at which your positions will be automatically sold to limit potential losses.

- Position sizing: Determine the appropriate size for each trade based on your risk tolerance and overall portfolio size.

Also Read: Adapting to the Future: How Digital Payment Solutions Are Transforming Businesses

Strategies for Cryptocurrency Trading

HODLing

HODLing is a strategy where investors buy cryptocurrencies and hold onto them for the long term, regardless of short-term price fluctuations. The term originated from a typo of the word “hold” in a Bitcoin forum post and has since become a popular approach among crypto enthusiasts.

Day Trading

Day trading involves making multiple trades within a single day to profit from short-term price movements. Day traders rely heavily on technical analysis and often use leverage to amplify their positions.

Swing Trading

Swing trading aims to capture price swings or “swings” in the market. Traders may hold positions for several days or weeks, taking advantage of both upward and downward trends.

Scalping

Scalping is a high-frequency trading strategy where traders make numerous small trades throughout the day, profiting from tiny price fluctuations. Scalpers typically focus on small gains but execute a large volume of trades.

Arbitrage

Arbitrage involves exploiting price differences for the same cryptocurrency on different exchanges. Traders buy low on one exchange and sell high on another, pocketing the price gap as profit.

Key Factors Affecting Cryptocurrency Prices

Market Sentiment

Cryptocurrency prices are highly influenced by market sentiment. News, social media trends, and public perception can trigger rapid price changes. Staying informed about current events and sentiment is crucial for traders.

Regulatory Changes

Regulatory changes can significantly impact cryptocurrency markets. Positive regulatory developments can boost confidence, while negative changes can lead to uncertainty and price volatility.

Technological Developments

Advancements in blockchain technology and cryptocurrency projects can influence prices. New features, partnerships, and upgrades can drive demand and impact the value of a cryptocurrency.

Market Liquidity

Market liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. Cryptocurrencies with higher liquidity tend to have more stable prices.

Risks Associated with Cryptocurrency Trading

While cryptocurrency trading offers potential rewards, it also comes with inherent risks:

- Volatility: Cryptocurrency markets are known for their extreme price volatility, which can lead to substantial gains or losses.

- Security: Hacking and fraud are prevalent in the cryptocurrency space. Storing your assets securely in hardware wallets is crucial.

- Lack of Regulation: The absence of consistent global regulations can make it challenging to address disputes or fraudulent activities.

- Emotional Trading: Emotional reactions to market fluctuations can lead to impulsive decisions and losses.

Taxation and Reporting

Cryptocurrency trading may have tax implications depending on your jurisdiction. It’s essential to keep accurate records of your transactions and consult with a tax professional to ensure compliance with tax laws.

Ongoing Learning

Cryptocurrency markets are dynamic and constantly evolving. Staying updated with the latest developments, trading strategies, and market trends is essential for long-term success in cryptocurrency trading.

Conclusion

In conclusion, to understand cryptocurrency trading is a multifaceted journey that requires knowledge, you will need practice, and ongoing learning. Whether you’re a beginner or an experienced trader, the cryptocurrency market offers opportunities for profit and growth. However, it also comes with risks that must be managed diligently. By mastering the basics, employing sound strategies, and staying informed, you can navigate this exciting and ever-changing landscape with confidence and success. Happy trading!